Due to AI and technology advancements, numerous companies are emerging, and some will eventually become unicorns. After a certain stage, companies tend to go public through an IPO, and during this phase, terms like “issue price,” ‘list price,” and “floor price” are widely used. In this article, we shall decode the meaning of these terms and understand their importance in an IPO.

IPO is fascinating; every decision we make can either lead to the pinnacle of our wealth or cause our downfall. Making a prudent decision at the beginning of an IPO determines the extent of our wealth, and to make them, we need a deeper insight into a few technical finance jargons like issue price, list price, and floor price. Before understanding the meaning of these terms, we shall first look into what an IPO exactly is.

What is an IPO?

An Initial Public Offering (IPO) is the process through which a private company goes public by offering its shares to the public for the first time. This allows the company to raise capital from a wide range of investors, which it can use to fund its operations, expand its business, and pursue new opportunities. In simple terms, an IPO is like a company’s debut on the stock market and is an important event for both the company and investors.

The IPO process involves several steps, including preparing financial statements, conducting due diligence, selecting underwriters, and setting the floor pricing for the shares. One way to think about the IPO process is to consider the cost of flooring. When you want to install new flooring in your home, consider the cost of materials, labor, and installation. Similarly, when a company wants to go public, it needs to consider the cost of preparing for the IPO, including legal and accounting fees, and selling its shares to the public.

The cost to do flooring can vary widely depending on the materials and the quality of the installation. Similarly, the price of an IPO can differ depending on the company’s size, the complexity of its financial statements, and the level of demand for its shares. However, just like investing in high-quality flooring can add value to your home, going public through an IPO can add value to a company by increasing its visibility, enhancing its reputation, and providing access to new sources of capital. Investing in an IPO can be valuable for investors to participate in the company’s growth and success. Now that we know what an IPO stands for, we shall learn about a few financial terms linked to this particular financial instrument. The first term that we shall explore is its issue price.

What is the issue price?

Issue price refers to the price at which new securities, such as stocks or bonds, are sold to the public during an initial public offering (IPO) or a secondary offering.

The issue price is usually determined by the investment banks or underwriters managing the offering. It is based on several factors, such as the company’s financials, market demand, and prevailing market conditions.

In an IPO, the issue price is typically set after the company has undergone due diligence and valuation by investment banks and underwriters. It is intended to reflect the fair value of the company’s shares or bonds at the time of the offering.

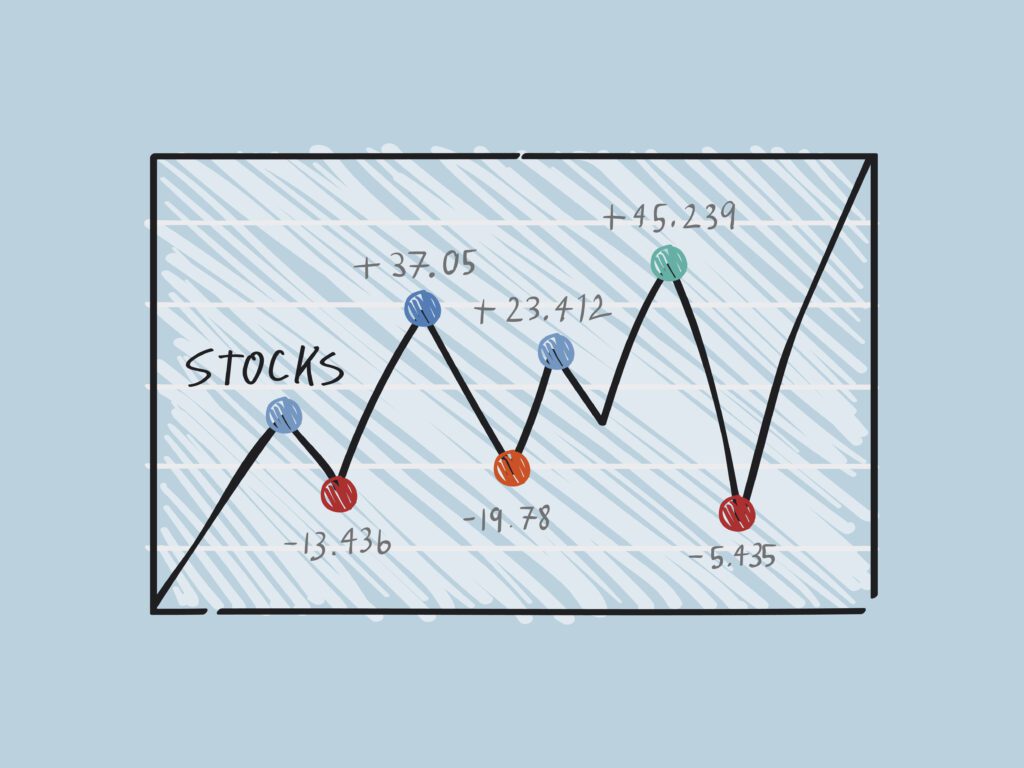

Once the securities are sold at the issue price, their market value can fluctuate based on various factors, including supply and demand, economic conditions, and the issuing company’s performance. Another term aligned with the IPO is floor price, the minimum price on which bids can be made in an IPO. Our next segment will focus on the essence of floor price in an IPO.

What is the floor price?

In an IPO (Initial Public Offering), the floor price refers to the minimum price at which company shares can be sold. The Securities and Exchange Board of India (SEBI) has mandated that every IPO must have a floor price, which the company and its underwriters determine. The purpose of the floor price is to prevent the shares from being sold below a certain price, thereby protecting the interests of the investors.

Floor pricing is an important consideration for companies planning to go public because it affects their valuation. A higher floor price indicates that the company is confident about its prospects and will likely attract more investor interest. Conversely, a low floor price can signal a lack of confidence in the company’s financial health, leading to lower investor interest.

On the other hand, the cost of flooring refers to the expenses incurred by a company in preparing for an IPO. These costs include underwriting fees, legal fees, accounting fees, and other expenses associated with the IPO process. These costs can be substantial, and companies must carefully consider the potential benefits of going public against the cost of flooring.

The cost to do flooring refers to the expenses incurred by a company in preparing for an IPO. Both floor pricing and the cost of flooring are important considerations for companies planning to go public, as they can impact the valuation of the company and the level of investor interest in the IPO. Listing price is another term synonymous with IPO: The issue price and listing price are two important concepts in finance and investing, especially when it comes to buying and selling stocks. Understanding their difference is essential for making prudent decisions when an IPO is announced.

What is the difference between the issue price and the listing price?

The issue price is the price at which a company sells its shares to the public during an IPO or a subsequent offering. The issue price is typically set by the company and its underwriters based on several factors, including the company’s financials, market conditions, and investor demand.

On the other hand, the listing price is when the company’s shares start trading on the stock exchange. This price is determined by the market forces of supply and demand, which may be higher or lower than the issue price.

It’s worth noting that the difference between the issue price and the listing price can have important implications for both the company and investors. If the listing price is higher than the issue price, the company may be able to raise more funds than it initially anticipated. On the other hand, if the listing price is lower than the issue price, it may signal weak demand for the company’s shares and could be a negative sign for its prospects. For investors, buying shares at the issue price may provide an opportunity to buy shares at a discount to the listing price, while buying shares at the listing price may involve paying a premium. Both issue price and floor price are essential considerations for companies planning to go public, as they can impact the valuation of the company and the level of investor interest in the IPO.

For minting money bags off an IPO, financial literacy is vital for individuals who want to invest wisely in the stock market. Companies like Logical Nivesh provide an excellent platform for investors to learn about complex financial jargon like issue price and floor price. By understanding the meaning of these terms, investors can make informed decisions and avoid costly mistakes when investing in an IPO.